what is tax debt forgiveness

After a debt is canceled the creditor. Is debt forgiveness a capital gain.

Ultimate Guide To Irs Debt Forgiveness Program Fidelity Tax

Although the American Rescue.

. Tax debt forgiveness is a broad term used to describe the various tax relief programs available to taxpayers who are unable to pay their tax debts. IRS tax debt forgiveness allows your debt to. The IRS will forgive your tax debt if you are unable to pay it in full after 10 years.

The IRS has 10 years to. Debt settlement or debt forgiveness is a last-resort option that can help debtors get out from under overwhelming balances. Debt forgiveness is when a lender reduces the amount of debt a creditor owes or wipes away the debt entirely.

In most forgiveness situations debt reduction comes with major. Tax rates are less than 100 so your net amount owed decreases. But as we mentioned in the above section on income-based debt.

IRS debt relief is for those with a debt of 50000 or less. These are the most common ones. The third type of tax result that some may consider tax debt forgiveness but is really more of a legal technicality is the debt expiring after about 10 years.

If you live in a state that will tax forgiven student loans how much youll owe depends on your state tax rate. Although you can apply for OIC on your own communicating with the IRS can be frustrating. These specific exclusions will be discussed later.

The tax impact of debt forgiveness or cancellation depends on your individual facts and circumstances. Debt forgiveness can help free up your financial resources and relieve a major burden. However the loan forgiveness element does not apply to private student loan borrowers who account for an estimated 8 of total outstanding student loan debt in the US.

In Indiana for example the state tax rate is 323. The IRS offers several tax debt forgiveness programs. InGen_Lab_Intern Additional comment.

You can also apply for the IRS. You are likely to get. The IRS has the final say on whether you qualify for debt forgiveness.

The process can take a few years but when its. A total tax debt balance of 50000 or below. Tax debt forgiveness is available if your solo income is below 100000 or 200000 for married couples.

Generally if you borrow money from a commercial lender and the lender later cancels or forgives the debt you may have to include the cancelled amount in income for tax. At any rate even being taxed on the loan forgiveness is still a net positive. In general though the agency looks for taxpayers who.

The canceled debt isnt taxable however if the law specifically allows you to exclude it from gross income. Whenever there is a loan balance that gets reduced in any way either with debt forgiveness a foreclosure a short sale or a cancellation. The Collection Statute Expiration Date CSED is the date ten years from when the tax got assessed and when the IRS writes off the debt.

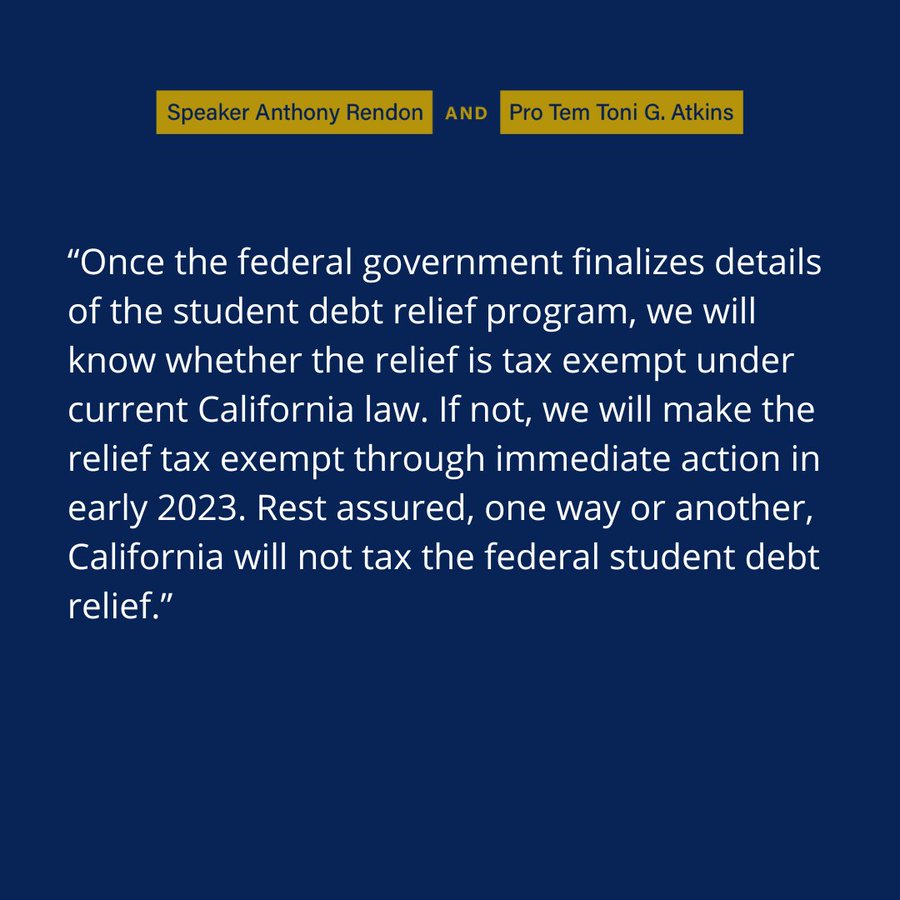

According to the Tax Foundation California has confirmed it will be treating Bidens student debt forgiveness as income for state tax purposes. The IRS Debt Forgiveness Program presents taxpayers with several options to catch up on their unpaid taxes. Offer in Compromise OIC With an Offer in Compromise the IRS accepts a lesser offer.

Unfortunately that 10-year timeline is rarely. Student loan debt forgiveness is approved up to 20000 per borrower heres who qualifies Heres how soon experts say Bidens student loan forgiveness will reflect in your.

Irs Debt Forgiveness Explained Understanding Tax Debt Forgiveness Program With Free Guides Youtube

Things To Know About Tax Debt Relief

What You Need To Know About Irs One Time Forgiveness

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

Irs Debt Forgiveness And Irs Tax Forgiveness Services

Tax Debt Relief Resolve Your Debt With The Irs Bankrate

What Is Tax Debt Relief Credello

Student Loan Forgiveness Taxable Or Tax Free Vin Foundation

Tax Debt Relief Irs Programs Signs Of A Scam

Best Tax Relief Options If I Owe 10 000 To 15 000 To The Irs

Tax Debt Relief 3 Ways The Irs Is Willing To Work With You Fidelity Tax

Achieve Tax Debt Relief By A Reduction In Irs Penalties And Interest

Is Student Loan Forgiveness Taxable Wthr Com

The Student Loan Forgiveness Application Is Live But Will You Owe Taxes On Debt Relief Cnet

Putting Student Loan Forgiveness In Perspective How Costly Is It And Who Benefits

6 Faqs On Tax Debt Relief Act Tax Relief Center

Payroll Tax Debt Relief How To Settle Tax Liability Tax Relief Center